Sample this for a travel:

Official: Where's your ticket?

You: Hey here, I paid for the ticket and the tax

Official: Well, darling, you don't know how to travel so, new tax rules applicable, after booking, for your own safety

You: WT...$%@#

Another:

How do you make something look good? Simple, turn the next available comparable good thing into ugly!

(And believing Mr. Jaitley when he makes such an amendment makes it so easy to love "good"!!)

How do you make something look good? Simple, turn the next available comparable good thing into ugly!

(And believing Mr. Jaitley when he makes such an amendment makes it so easy to love "good"!!)

Let's start with pointing out the bigotry and confusion first:

Mr. Jaitley:

While in opposition , he demanded minimum IT slab should be fixed at 5-lakhs and that was 2 years back!!

BJP leaders kept targeting UPA govt on fiscal deficit, inflation, fuel price hike, Re-Dollar exchange rate etc.

While in power:

No changes in tax slabs; imposition of various additional taxes, excise and cess!

Despite having most benign commodity prices, including fuel, witnessed in past decade, struggling to keep inflation and fiscal deficit under check, domestic fuel prices not coming down, and middle class burdened with huge taxation, nothing much on the Re-Dollar front too!

Mr. Jayant Sinha:

MoS Finance first expressed helplessness conveying that ALL long term savings product need similar tax treatment, then next day clarifies that PPF will continue to remain tax-free:

What the Budget speech text says:

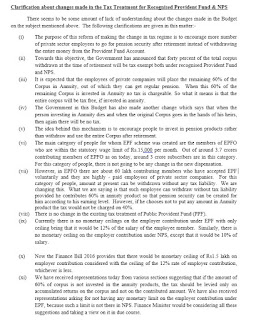

What the clarification on Mar 01/2016 says:

And this is how the public reacted:

Before ascertaining the real intentions, let's look at some earlier and recent developments:

- Direct Tax Code was proposed few years back, arguing to move to EET regime of taxation. Good on paper, but very problematic NPS was introduced even before DTC on this EET principle and, knowing well that most people may not be interested to go NPS way, govt servants were pushed to this scheme (still better than EPS though)

- To encourage NPS contributions, Budget 2015 increased limit of NPS investment and provided additional tax-exemption, even for non-salaried persons.

- Budget 2015 also did away with the minimum EPF contribution required from employee salary for those earning below some level of income

- Again in Budget 2015 speech, Mr. Jaitley himself said "It has been remarked that both EPF and ESI have hostages, rather than clients"

- Few days before the budget, the EPF withdrawal rules were unilaterally modified without any consultations with anyone.

- Economic Survey painted the tax payers as rich and sort of villains, seemingly gaining from the subsidies which should be used by poor. (Interesting to note in this Survey, gold consumption is heavy in villages too, no rich asked to not tax the gold. Also, ATF taxed below petrol, because petrol was heavily loaded with taxes, courtesy Mr.Jaitley. It's amusing that something of the govt own wrong-doings is blamed on the tax-payers/rich.)

- But, Economic Survey also argued to make EPF contribution voluntary for low-income group to help them make their own decision

- As per news from Seventh Pay Commission, lowest monthly pay of govt employees will be upwards of Rs. 18,000/- (not withstanding the automatic DA increases half-yearly/quarterly)

- Budget speech made an announcement that govt will bear the employer component of EPF contribution for 3 years for new jobs created in low-wage (sub Rs 15K pm) categories... (Hey, some companies like Infy, TCS, etc have entry level packages for engineers in this range, wonder if these "rich" will be allowed to corner that contribution? Those who think I'm blabbering, check for yourselves some survey data here for entry level Software developer pay-scale)

Conclusions drawn and question that arise are:

- Govt is definitely not happy with tax-payers earning tax-free interest anywhere, even though tax has already been paid on the principal before investment

- By some strange logic, EPF contribution should be coercive for higher income group (HIG) but not for the lower income group (LIG)? Tax be levied on 60% EPF corpus of HIG to coerce them to move to annuity but, not on LIG? Who is more vulnerable : HIG or LIG? So, LIG should have choice to wither away the EPF corpus but HIG be restrained? This is a sure shot win-win for govt, here's why:

- LIG will "consume" the EPF corpus and be back to govt for various doles and thus a forever exploitable vote-bank for govt

- HIG corpus for annuity will go to some govt controlled or private players - good employment for lazy govt staff or else good quid pro quo opportunity thru licenses for private fund manager companies, excellent way to attract FDI from MNC Insurance and Pension funds

- The claim that contribution to Annuity will be tax-free is again half-truth - Annuity is again EET - i.e. the monthly payout from annuity is tax deductible and again, as per the income slab

- Talking about slab, dear FM, can you please tell me, when I have no job at the end of 60yrs, or because of voluntary retirement or termination, how will you decide the slab? Why should the highest slab still be applicable when I have no job altogether at the time of withdrawal?

- Similar question on slab regarding Rs 15,000/- income group tax exempted EPF -- this 15K will be considered at the time of first entry to EPF or at the time of exit from EPF or will change dynamically year on year based on that year's income?

- Why should I not get the benefit of indexation on EPF corpus?

- At the time of entry rules are different, then while changing rules, why should I not get an exit option? Even black-money hoarders are being given an option to keep their money, why not an honest tax-payer like me?

- If intention was not tax-extortion, what was the need to first change the withdrawal rules and then announce EPF taxation?

- The current EPS scheme is a complete black-hole, I tried to read and understand, but I still don't know how I'll get the pension given I've changed a couple of jobs and the EPS fund is not transferable. If Mr. Jaitley is really serious about "pensioned society", start from overhauling EPS, let that contribution be transferred to NPS first before touching the EPF

- Articles upon articles have been written about the well-intentioned-but-stupid product NPS. Why can't govt remove the negative points from NPS first and then talk about pensioned society? Too much to ask? (Infact, there's now admission from the horse's mouth, excerpt below)

- Even otherwise, the move is obnoxious given that majority of the tax (75%) is being paid by top 5.6% tax-payers in the 10-20 lakhs slabs, yet they should again be burdened with extra EPF tax!! (BTW, this 5.6% of all tax-payer means, less than 20 lakhs people i.e. 0.2% of overall population!! Please these are people not companies unto themselves; it's amusing that companies with this kind of income get numerous exemptions {apart from black money generation}, but zilch available for these set of tax-payers who are taxed at source)

- The press release shared by Mr. Jayant Sinha, gives an impression that govt employees will be excluded from proposed EPF tax notwithstanding their pay-scale. Perfectly legit, given that most of us, including the govt, knows that govt servants generate enough black-money thru corruption which will see them off without any need of pension. Right?!

- Govt want to squeal every bit out from "high-earning" private employees but, is govt oblivious of the fact that given current slowdown and even otherwise, e.g. due to individual/company performance, business wind-up etc, these private employees lose their jobs altogether, while govt employees enjoy continuous job. Hey, but tax incidence is on private employees! Given Mr. Jaitley is so very ready to extort this lot, is there any scheme to help them in their difficult phase? NO!!

Above queries definitely give a hint that real intention is tax-extortion only!!

Enormity of Tax incidence

Given that absurd statements from Ministry that the EPF tax is not much, let's see a simplistic illustration of 2 cases, assuming fixed income through-out employment tenure and 8.5% p.a. as EPF interest rate :

For a person in private job, assuming his total monthly (self + employer) contribution to EPF is Rs 1,000/- per month, i.e. Rs 12,000/- yearly contribution and another person with Rs 1.5 lakhs per year contribution (i.e. the pain point threshold for govt):

*Tax has been calculated as slab rate (10% or 30%) of 60% EPF interest

So, you see, the enormous robbing effect of this EPF tax .. the longer you serve, the more you get robbed! Just ask anyone showing this data, whether he would be happy to be forced to invest in such a scheme!!

(silver-lining: may be govt wants private sector employee to shun his job and start #MakeInIndia to save on taxes :-) )

If the govt is really serious about the post-retirement pension income, then bring in a full blown EPF reform altogether. Remove the coercive clauses regarding contribution. I'll use the 1.5lakh limit for other purposes like tuition fee of children, insurance etc. and invest the PF money into some PPF or other market-linked instruments like MIP, ELSS etc.

Make provisions for MFs to start a Debt Linked Savings Scheme on the lines of ELSS, where the returns are market linked and profits completely tax-free after certain lock-in period.

Make provisions for MFs to start a Debt Linked Savings Scheme on the lines of ELSS, where the returns are market linked and profits completely tax-free after certain lock-in period.

Tax me once, don't keep coming back to milk us salaried middle-class honest tax-payers!

Though, yes, we did learn in a bitter way how costly are the dreams that Mr. Modi painted in various election rallies - situation would have been different if we knew these taxes are coming our way first before any action on the corrupts, business cronies etc.

Request/Suggestions to FM/PM

I would like to sum-up with following :

* Make EPF contributions completely voluntary, may be, except for some small fixed upper ceiling of upto Rs 5,000/- pm

* Roll back the EPF tax completely. If you find it difficult to avoid the EPF tax lust, please:

- Give a break for 1 Financial year, use it for public consultation, and give option to people to withdraw existing EPF savings without tax

- For future contributions allow indexation benefit at the time of exit

- Remove negative points from NPS, instead of destroying EPF like NPS

- Bring in clarity on applicability of slabs at the time of withdrawal

- If you want tax of your choice, give me the investment freedom of my choice

* Roll back the recently introduced withdrawal rules

* Bring in attractive annuity schemes, such that people voluntarily opt for it

* Bring in DLSS (Debt Linked Saving Scheme) on the lines of ELSS

* Bring in DLSS (Debt Linked Saving Scheme) on the lines of ELSS

* Overhaul the EPS, black-hole, allow transfers and portability to NPS

(Disclaimer: I used to be a BJP supporter, but given the slew of taxes imposed and non-action on cronies/corrupt by the current govt, I'm of the firm belief that BJP should not get majority in Rajya Sabha! I shudder to think how many more taxes will get imposed once the BJP gets full majority!)